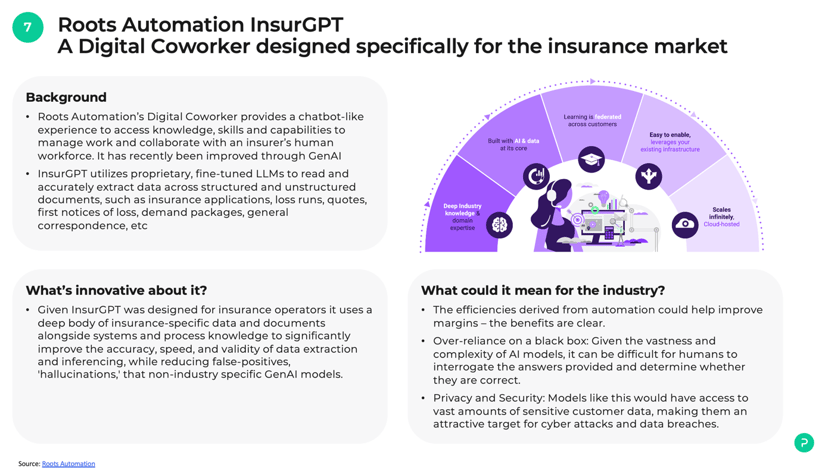

The insurance industry is undergoing a profound transformation, driven by technological advancements. Digitalization, data management, and fraud prevention have emerged as significant challenges. However, real change is possible through "Gen AI," which combines advanced automated statistical modeling with powerful data processing and context comprehension.

In our report: "Generative Artificial Intelligence, seven opportunities for insurers to realize value from A today" we explore the transformative impact of Generative AI on all areas of the insurance industry and how this technology raises potential solutions for improvement. Download for free.

The Current Landscape of the Insurance Industry

The insurance industry is experiencing a significant digital shift, redefining operational standards. Yet, this transformation comes with complex technological challenges like:

- Digitalization: The transition to digital systems and effective electronic information management.

- Data Handling: The efficient processing and analysis of vast data volumes.

- Fraud Prevention: The proactive and precise identification of fraudulent activities.

How Gen AI Addresses Industry Challenges

Automation and Data Processing

In the realm of automation and data processing, insurers often grapple with the challenge of transitioning to digital systems, which includes managing the immense flow of electronic information, risk assessments, and claims processing. This multifaceted task can be complex and impact operational efficiency and decision-making, making it crucial for insurers to leverage advanced technologies to address these challenges effectively.

Key AI tools to improve this:

Machine Learning Tools: Gen AI leverages advanced Machine Learning tools such as TensorFlow and Scikit-learn for lightning-fast processing and analysis of extensive datasets. These tools enhance decision-making and risk prediction.

Cloud Storage Platforms: Utilizing solutions like AWS, Google Cloud, and Azure, Gen AI benefits from large-scale data storage and processing capabilities, facilitating rapid AI model deployment.

Automated ETL (Extract, Transform, Load): Tools like Apache NiFi and Talend automate data processes, optimizing data collection and real-time analysis, enabling insurers to make informed decisions swiftly.

Here is a good example we researched to further explore the topic, demonstrating how data can yield benefits in the insurance industry: Roots Automation InsurGPT.

Fraud Prevention

The insurance industry faces relentless fraudulent activities that threaten financial stability. Traditional fraud detection methods often fall short in identifying sophisticated fraudulent behavior in real time, leading to substantial losses and operational disruption.

Key AI tools to improve this:

Neural Network Analysis: Leveraging tools like Keras and PyTorch, AI in insurance identifies patterns and anomalies in behavior and transactions that traditional methods may overlook, bolstering security and reducing fraud-related losses.

Anomaly Detection Systems: Specialized software like Apache Kafka processes real-time data streams to detect suspicious activities, enabling insurers to proactively respond to potential threats.

Policy Customization

Historically, insurers have struggled to tailor their offerings to meet the unique needs and preferences of individual policyholders, resulting in dissatisfaction and hindered customer retention.

Key tools to improve this:

Clustering Algorithms: Gen AI segments customers into different groups based on characteristics and behaviors, utilizing methods like DBSCAN or K-Means. This enables personalized policies and higher customer satisfaction.

Predictive Analysis Tools: Software like RapidMiner and Alteryx predict future policyholder behaviors, allowing insurers to adapt policies accordingly for enhanced customer retention.

Optimizing Customer Experience

Enhancing the customer experience remains a pivotal challenge. Inefficient customer service processes can result in customer frustration and decreased loyalty.

Key tools to improve this:

Intelligent Chatbots: Platforms like GPT-3, Dialogflow, and Microsoft Bot Framework offer chatbots that promptly address FAQs and resolve customer issues, elevating satisfaction and reducing operational costs.

Virtual Assistants: Using Natural Language Processing (NLP), virtual assistants like Siri, Alexa, and Google Assistant help customers with inquiries and transactions, improving accessibility and customer interaction.

Recommendation Systems: By employing collaborative filtering techniques, recommendation systems suggest products or services based on customer preferences and past behaviors, driving cross-selling and customer satisfaction.

Conclusion

Generative AI in insurance has become a pivotal force in reshaping the industry by effectively addressing its most prominent technological challenges. With advanced machine learning, data automation, and enhanced fraud detection, insurers can provide more efficient and personalized services while enhancing security and reducing fraud risks. The synergy between artificial intelligence and the insurance industry paves the way for a more promising and secure future for policyholders and insurers alike.

For a deeper dive into the potential of Gen AI in the insurance industry, download our report on "7 Opportunities of Gen AI in Insurance" today.