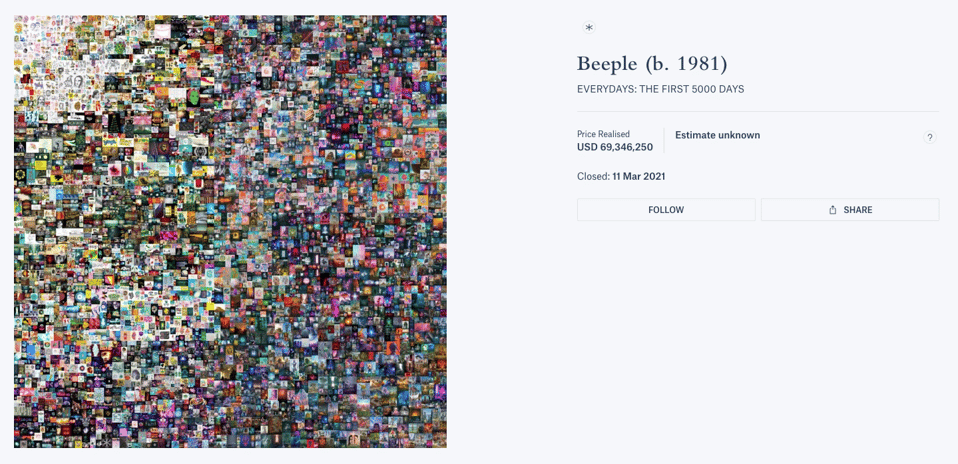

But wait - Isn't Web3 especially Crypto this volatile space that made headlines (for the wrong reasons) last year? Why and how would it be of any use in driving customer growth? Now, you might have noticed in recent days your Instagram or Tiktok feeds would probably be filled with people with avatars of their favorite NFTs. You might also recall last year in March, someone bought an NFT artwork for US$69M - a picture on the internet!

Source: Christie's

Source: Christie's

The immense value and influence the Web3 space has wielded on society is undeniable - and it's going to grow exponentially. Amidst the hype and risks, there are practical ways that brands can now capitalize on to grow their business . Here are 5 of my favorite ones.

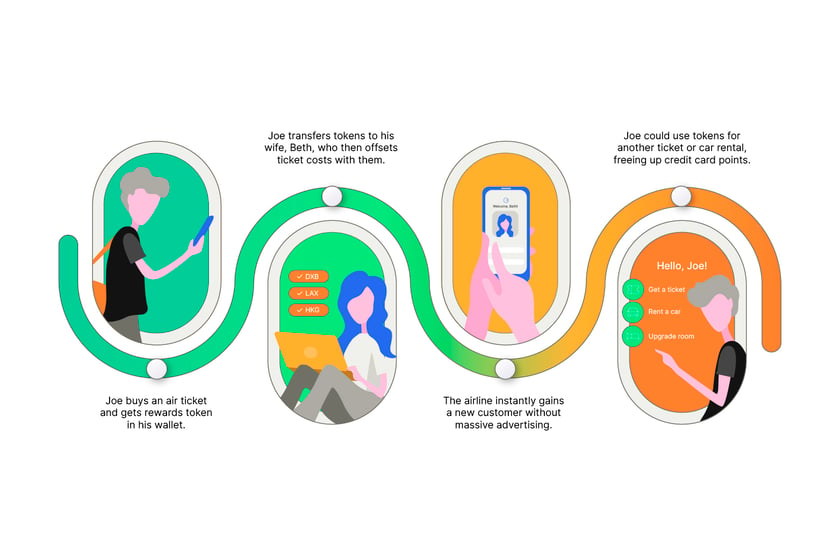

Use blockchain reward programs to win new customers

While many have crypto wallets today, their usage in the physical world remains nascent. In Asia, besides cash, loyalty points is the default way to pay. Few would think about creating their loyalty program on a blockchain - but it has real world benefits that complement existing programs.

Imagine this - Joe buys an air ticket and has rewards token transmitted into his wallet. He might transfer some of his tokens to his wife Beth, who is new to the airline but uses it to offset the cost of a ticket. Traditionally, if she’s not an airline member, she won’t be able to enjoy these rewards. Now, the airline has gained a new customer organically without massive advertising. Joe could also use tokens for another ticket or car rental – freeing up his traditional credit card points for say a room upgrade – extending his spending power.

These journeys don’t have to be designed in standalone infrastructures. Smart contracts, which are self-executing programs between two parties, can interact with legacy systems and transmit transaction records without holding personal identifiable information (PII) that still sits in existing CRMs.

“We are seeing massive growth in this space across industries from retail to travel. What's exciting is that it's not about a new technology replacing another. With the right conditions, blockchain can grow to become a new channel for customer acquisition - extending the effectiveness of current rewards programs,” Yudesh Soobrayan, Head of innovation, PALO IT.

Extend (or experiment) your product lines with NFTs

Non-fungible tokens, part of the Ethereum blockchain, are digital assets that enable a single individual to have clear ownership of it. It can be stored, bought, or exchanged in the marketplace. They can be drawings, music, even tweets! The founder of Twitter sold one for under US$3M in recent times.

The ability to digitize almost anything has led to the rise of both creators, buyers and investors in the NFT space. The NFT market is reported to grow 35% into a US$13.6B industry by 2027. Investors are joining the bandwagon NasDaq reported crypto startups in infrastructure, NFTs and gaming received more than $3.5 billion in VC cash in the US in March 2022 alone. Major brands in the retail space in particular have used NFT to create 'one of a kind’ experiences designed to create media buzz while and purchase intent.

“NFTs are very accessible and with its value extending beyond the single trading dimension of a bitcoin, it could become Web3's doorway to traditional commerce,” Eugene Yang, Business Director, PALO IT Singapore

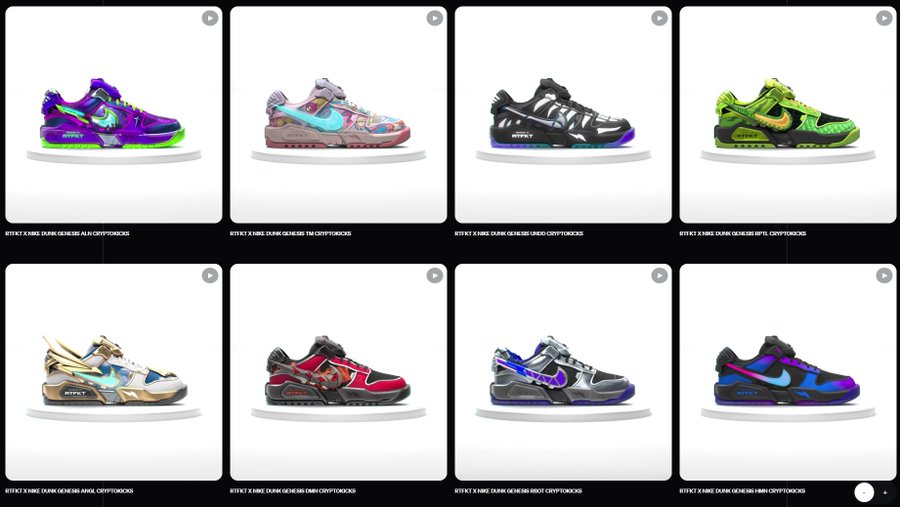

Source: Hypebeast

Harvey Nichols in Hong Kong created their first NFT retail space allowing customers to buy curated digital art from globally renowned artists. Nike launched the Nike Dunk Genesis Cryptokicks, a collection of 20,000 NFT sneakers that owners can visualize in the real world through a Snapchat filter.

“Brands could also use NFT as a means to attract a new clientele through virtual try ons or assess demand before extending the product ranges in real life. It presents an opportunity to bridge the ‘phygital’ gap traditional retailers have without overhauling existing retail operations.”

Source: Cnet.com

Offer B2B ‘sustainability as a service’

As the cryptocurrency industry grows, companies as well as individuals are becoming more and more aware of the environmental impact of crypto mining and minting - an energy intensive exercise that has a massive ecosystem impact. A single bitcoin transaction according to Digiconomist is 1,460.68 kWh which is equivalent to the power consumption of an average U.S. household over 50.07 days. Digiconomist further estimates that the Bitcoin network as a whole is responsible for an estimated 114 million tons of carbon dioxide per year— equal to the amounts generated by the Czech Republic.

“You have about three million machines around the world participating in a massive game of ‘guess the number,’ generating 140 quintillion guesses every second of the day, nonstop,” said Alex de Vries, a data scientist who created the Bitcoin Energy Consumption Index.

Having said, there are ways to mitigate these climate effects at a system design level where the choice of technology architecture and governance design forms part of the solution to reduce energy consumption and they start at a high strategic level.

The World Bank Climate Warehouse, for example offers client countries access to an ‘observation node’ that allows all users to verify and report their emission data transparently effectively building in transparency as a design choice that supports their commitment to the Paris Agreement Article 6 – an agreement that “allows countries to voluntarily cooperate with each other to achieve emission reduction targets set out in their NDCs. This means that, under Article 6, a country (or countries) will be able to transfer carbon credits earned from the reduction of GHG emissions to help one or more countries meet climate targets.”

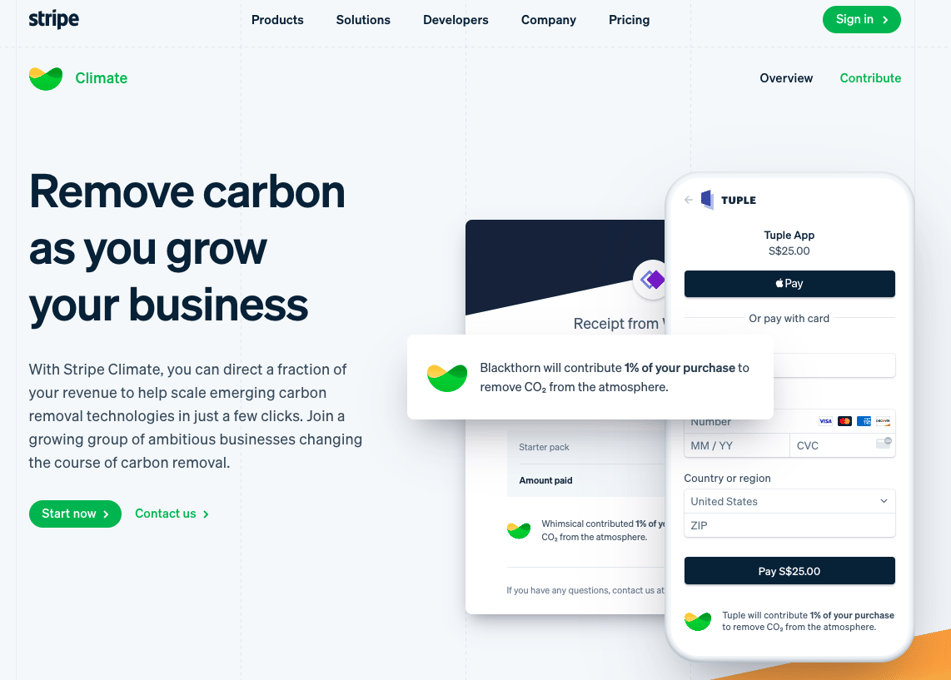

Another example is Stripe, which offers companies a carbon offset feature that allows them to use a part of their revenue to offset their carbon footprint – Stripe has recently reinforce this commitment by investing more R&D in diversifying more of such similar services.

Source: Stripe.com

Source: Stripe.com

Cut friction in payment experiences through new tech & business models

Having a crypto wallet to pay an individual, retailer or business by way of stablecoins is here to stay. Major retailers like Starbucks or Microsoft are accepting Bitcoin as payment. MasterCard has joined hands with Amber, CoinJar and Bitkub to issue Crypto linked cards in APAC. Visa reported their US customers have made US$2.5Bn in payments on Crypto cards in the first fiscal quarter of 2022. With the growing acceptance of Crypto for trade, we will start to an influx of diverse services that will be essential to create better user payment experiences in the year to come. This means more technology partnerships and integration can be leveraged without building from scratch. Here are some examples of services that will impact user experience.

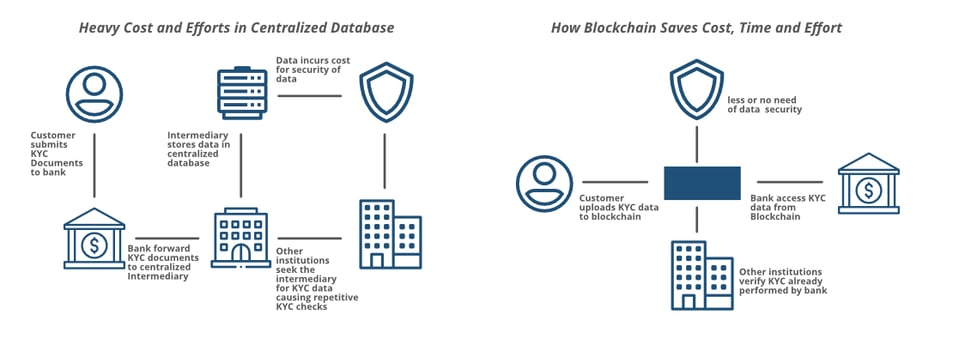

Accelerated KYC / AML checks through blockchain. The current KYC process on major Crypto exchanges currently still takes a few days and, in some cases, can take up to 10 days – it's the same story with financial institutions. Blockchain provides a decentralized network where customer information is updated by individual organizations and is made accessible to any organization or individual who requires it. This eliminates duplication of work and other inefficiencies in traditional KYC/AML processes.

Source: hww.geeksforgeeks.org/blockchain-and-kyc

Source: hww.geeksforgeeks.org/blockchain-and-kyc

‘No fee’ transactions and value-added services will become a norm. CryptoVantage reports a typical transaction on an exchange is 0.25% for both parties and takes 15-30mins for confirmation. Newer revenue models are emerging where exchanges offer low to no charge for transactions - which means almost instant confirmation, but offer various services that will further benefit both retail and corporate traders. Lykke, a swiss crypto exchange for example don’t charge trading fees but charge for insurance and consulting services.

Enhances customers’ safety with screening tech

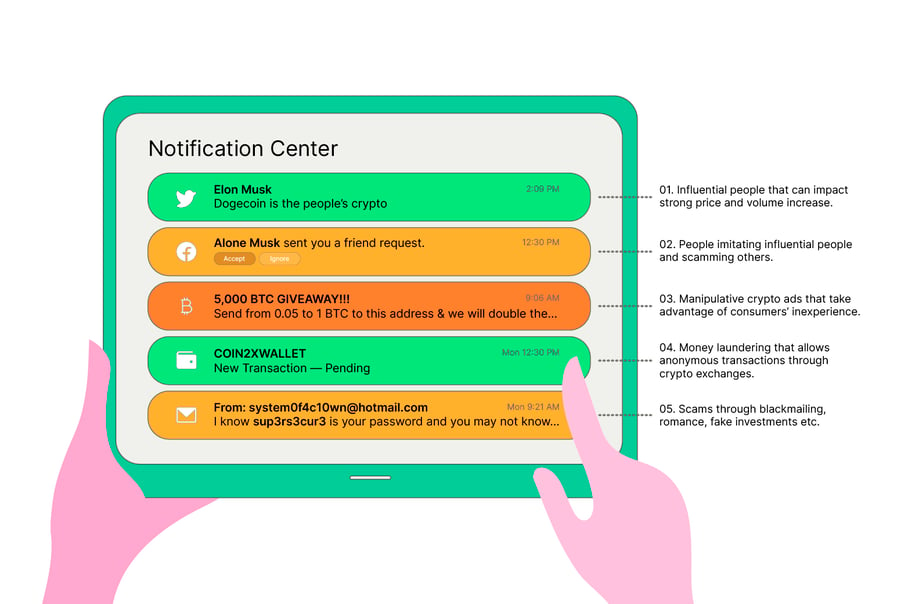

Beyond Crypto’s inherent volatility, there are a plethora of dangers that put customers’ personal data and assets at risk. Some examples include,

- People imitating people of significant influence and scam users

- People of influence making assertions that can lead to strong price and volume increase (eg. Elon Musk)

- Manipulative ads that promos crypto assets that take advantage of consumers’ inexperience

- Money laundering which allows anonymous transactions through crypto exchanges

- Scams like blackmailing, romance, fake investments..etc.

“This is an ecosystem play where everyone has a part to mitigate the risks. Having said, from a technology stand view we expect to see new solutions that will ensure customers’ data and assets are safe. For example, accelerating KYC, automating advertisement screening and automating transactional activities screening,” Eugene Yang, Business director, PALO IT

Web3 is converging rapidly with the real world, and while there are risks, there are also practical ways enterprises can leverage to grow their business. This reminds me of the days when cloud computing was first introduced in the late 1990s. There were major criticisms and debates around data portability, confidentiality and vulnerability which continued till this current day, but today the largest technology companies have all built formidable businesses and services on cloud - think Google, Microsoft and Adobe. Like any ‘new world’, Web3 offers many new ways to grow - but only for the brave.

If you are looking to create new world applications in Web3 or the Crypto space, speak with me at jkwah@palo-it.com or click on the button below.